How is Hard Money underwriting more art than science?

High volume Conventional lenders world use Automated Underwriting (AU) engines to determine if a borrower qualifies for a loan. Fannie Mae’s Desktop Underwriter (DU) and Freddie Mac’s Loan Prospector digest reams of quantitative data and spit out the yes or no decision on a residential loan. FICO’s, income, expenses, debt ratios and other data mix with coded rules and are processed through these Automated Underwriting programs. The loan decision reflects the desires of the ultimate investors on these financing requests. The software takes much of the decision making on a loan out of the hands of people and into the hands of a computer. These conventional loan AU systems provide consistent and high volume decisions and high volume.

Hard Money underwriting on the other hand is more art than science. In Hard Money, knowledge does not equal understanding. Data elements are important but need to be interpreted and matched with the “story” and borrower character to provide a quality underwriting decision.

I met a hard working couple the other day and they needed some additional money to finish their fix and flip. They had bought the land with their own money and were a little short to finish the construction. We gathered the same data that many banks reviewed before they denied this construction loan. However, when I met the couple and shook their hand and looked at the quality of construction, examined their experience and heard their story, we made the loan.

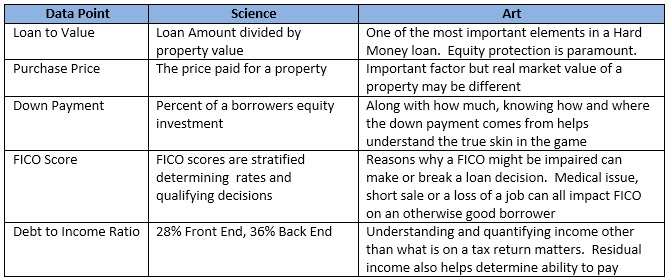

The following table describes the differences between the numerical data, the knowledge that data provides and the application of that knowledge into an understanding that can be used to provide the underwriting decision:

While, Watson, Artificial Intelligence and rules engines provide wonderful benefits for the masses, it is good to know that real people who are hard money lenders make underwriting decisions by art and not just science. Do you have a underwriting tip?