What is happening in the Fix and Flip marketplace?

Change and upheaval constitute Fix-and-Flip finance today. FinTech (High-Tech Lenders) companies, Wall Street and others have entered the Fix-and-Flip lending arena with an avalanche of capital. This new capital benefits borrowers with lower rates but is creating havoc with traditional lenders who are scrambling to keep up.

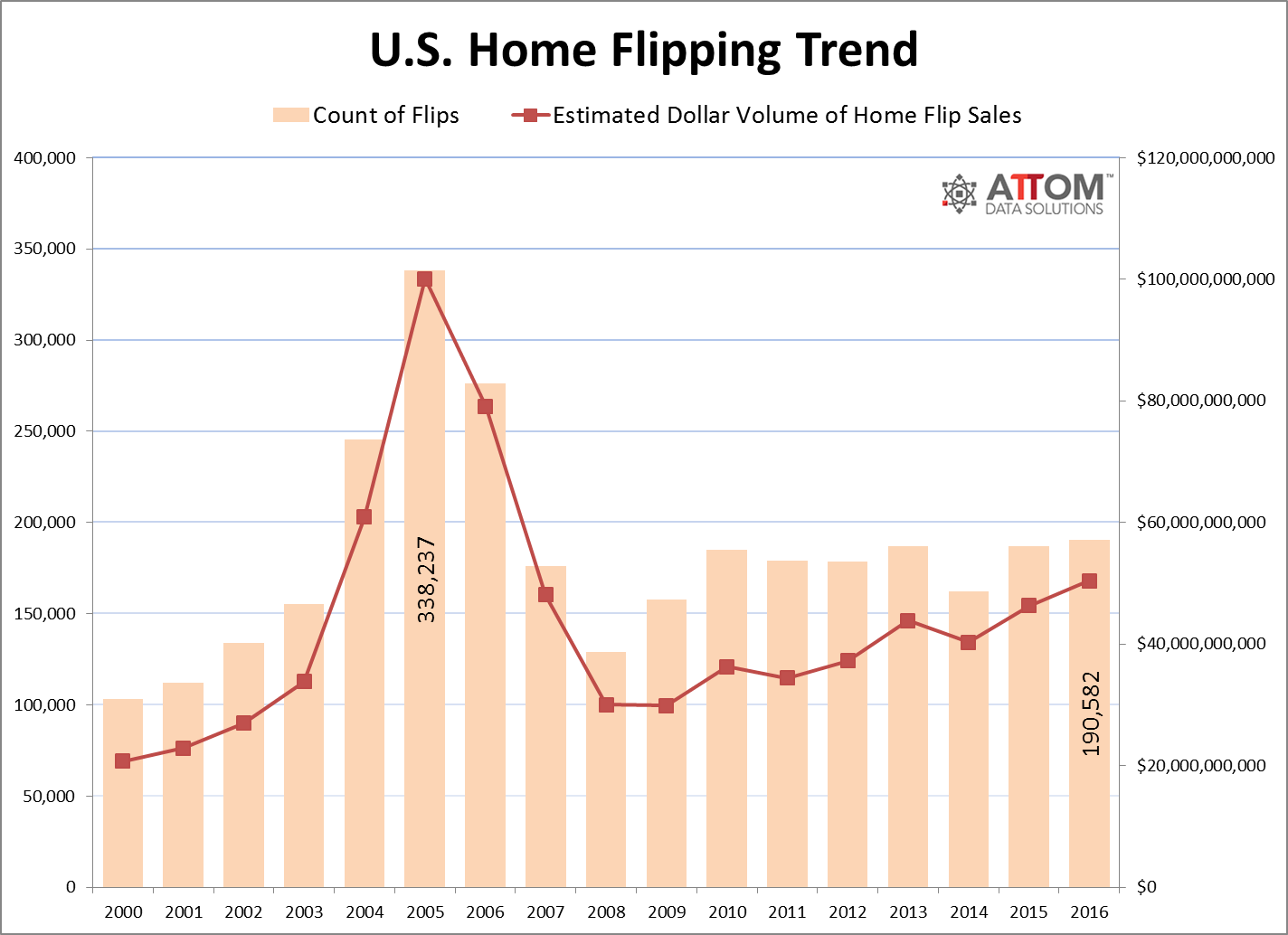

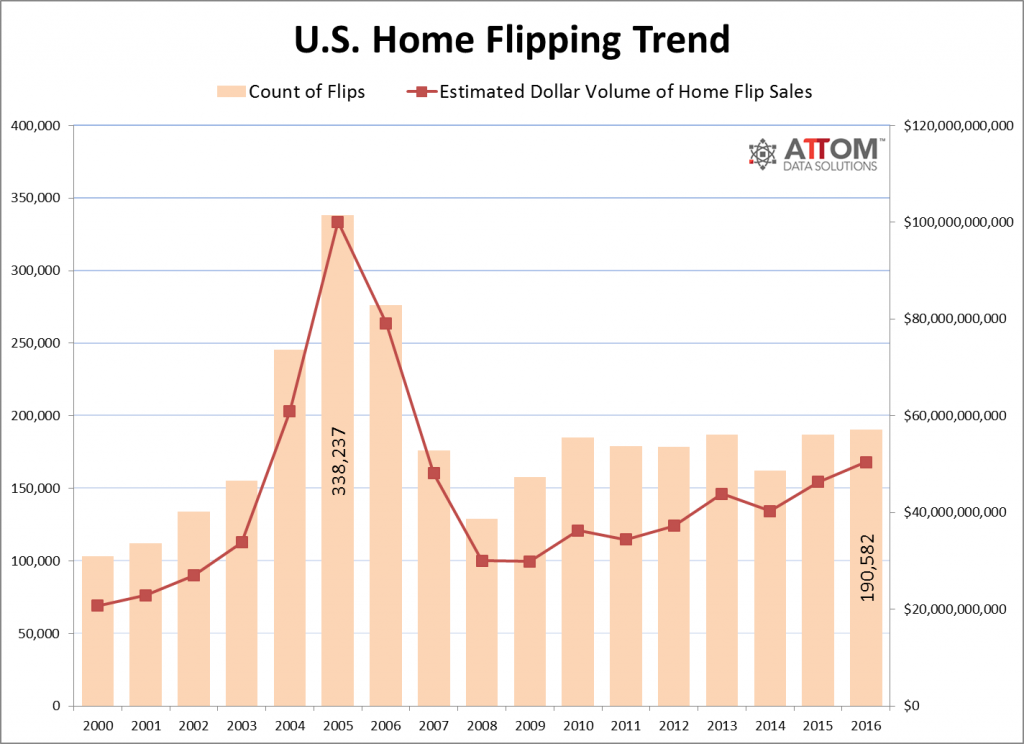

Increasing amounts of Fix-and-Flip loans as seen in the chart above benefit communities and are proven way for real estate investors to gain access to much needed capital. However, house flipping, a potent symbol of the real-estate market’s excess in the run-up to the financial crisis, is once again becoming hot, fueled by a combination of skyrocketing home prices, venture-backed startups, and Wall Street cash, and more than likely many personal loans.

The best way to summarize the breadth and scope of the sea change in Fix-and-Flip Finance is to provide the following 5 Elements of Change that apply to real estate investors, borrowers, and lenders:

- New Fix-and-Flip Loans Models Emerging

- While Conventional Lenders continue to dominate the owner occupied fix-and-flip loan market, investment property Fix-and-Flip Lenders now include: HARD Money Lenders, Mortgage Pools, Crowdfunders, FinTech companies, Hedge Funds and Wall St. firms.

- Big banks are offering these various lenders credit lines ranging from $5 million to $150 million, with interest rates between 3.5% and 6%.

- Importantly, some of the new financing models do not provide the real estate as collateral for the loan.

- Fix-and-Flip Mortgage Bonds

- Wall Street and new online lenders are bundling loans for home flippers into fix-and-flip mortgage bonds, offering a new way for hedge funds, private equity firms and other institutional investors to invest in the housing market.

- Making bonds out of fix-and-flip loans will accelerate a much-needed makeover of U.S. housing stock, but these bonds may lead to additional risk for all stakeholders.

- Mortgage bonds, also known as mortgage-backed securities (MBS), allow large investors to buy mortgages in bulk, freeing up the balance sheets of lenders so they can fund more loans.

- For decades, this has increased credit for regular homebuyers. Fix-and-flip mortgage bonds should offer a similar benefit to home flippers.

- The bonds build on a recent transformation in financing for home flippers. Home flippers previously could only obtain credit from “hard-money lenders,” who were typically local and used “country club capital” to fund loans.

- The Changing Fix-and-Flip Market Dynamics

- The number of investors who flipped a house in the first nine months of 2016 reached the highest level since 2007. About a third of the deals in the third quarter were financed with debt, a percentage not seen in eight years.

- That’s in part because home prices across the country are rising, reaching levels not seen since before the 2008 financial crisis. Housing also is in relatively short supply. Meanwhile, low interest rates and a surge in demand for homes from institutional buyers have also benefited house flippers.

- Investors are making an average profit of about $61,000 on each flip, up from about $19,000 at the bottom of the market in 2009, according to housing-research firm ATTOM Data Solutions, which is the parent company of real-estate website RealtyTrac.

- The market for house-flipping loans in the U.S. is expected to reach about $48 billion in total sales volume this year, the highest since 2006, according to ATTOM

- ATTOM said profit margins are getting squeezed in some markets. While house flippers typically aim to purchase a house at a 30% discount to the market, in some areas they’re buying homes at a 15% or 10% discount, said Senior Vice President Daren Blomquist. The research firm noted that the number of smaller, inexperienced house flippers entering the market is a sign of rising speculation.

- Rates are Down, Loan to Value’s are Up, But What About Loan Performance?

- Some online lenders use lines of credit from investment banks to underwrite six-to-18 month loans that cover up to 90 percent of a property’s purchase price and 100 percent of rehab costs, with rates ranging from 7.5 percent to 15 percent. Watch out! Any hiccup in the payment or property could be trouble.

- The capital fire hose has slashed loan origination fees for home flippers and driven down rates to a general range of 8 percent to 12 percent (or less for the most experienced flippers) from a range of 12 percent to 15 percent only a few years ago, industry observers say.

- There are only imprecise ways to measure home-flip default risks. The average foreclosure rate for loans secured by investment properties is 0.43% compared with 0.6% for loans on owner-occupied homes, but the foreclosure rate for investment property loans originated in 2016 is more than double owner-occupied homes, according to ATTOM.

- Less Cash Sales means More Fix-and-Flip Financing

- About one-third of flip loans were financed in 2016, the highest rate in eight years but still far below a 2005 peak of two-thirds, according to Attom Data Solutions. Meanwhile, the total sales volume of home flips hit a 10-year high of $50.4 billion, while the gross profit per flip reached its highest level since at least 2000, according to the data provider.

- According to a CoreLogic report, cash sales made up 32.1% of all home sales in 2016, falling 2.2% from 2015’s total. That’s the lowest annual cash sales share since 2007, when cash sales accounted for 27% of total sales.

The trick going forward for real estate investors and lenders is to embrace these changes, evaluate new hard money loan programs and capitalize on market opportunities. Real Estate remains a niche business and while these large institutions continue to try and tap into this asset class, they struggle with nuanced scenarios and short term loan durations. Individual investors and flippers can still win!

Do you need a Fix-and-Flip Loan? We would like to know. Please review the Mortgage Vintage New Fix-and-Flip Loan Program and submit a request-a-quote.