Unlock Your Property’s Potential in 2024: Cash Out

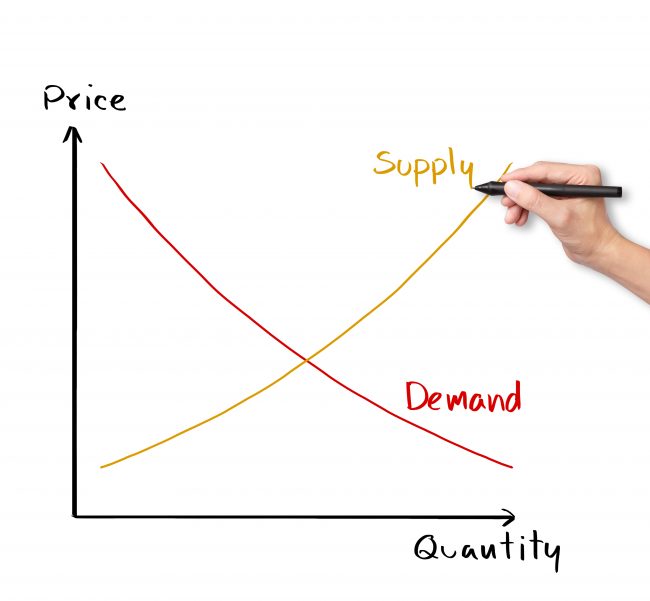

It’s time to seize the opportunities presented by the dynamic housing market of 2024. Home prices in California continue to rise and set new records. Data from Houzeoi reports that California homes continued to sell at eye-popping prices in early 2024. The median home sale price rose 6.5% year-over-year from $693,800 to $739,100 in January 2024. The…