What are the influences on hard money loan rates?

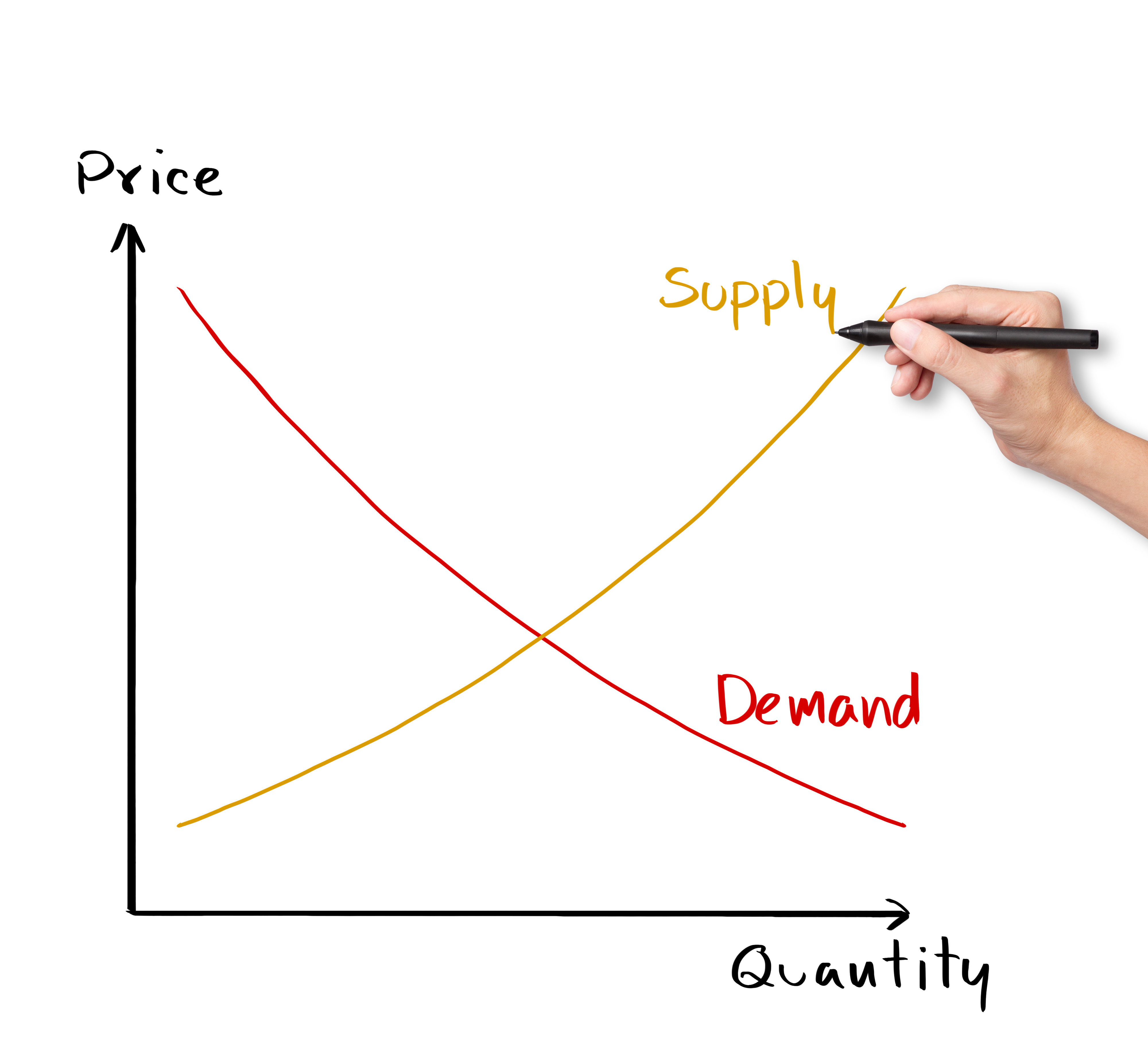

With conventional mortgage rates near historic lows, I often get the question about: “What factors impact Hard Money Loan Rates (HMLR) and the subsequent yield on Trust Deed Investments?” The influences on conventional rates funded by our Government vs. hard money rates funded by private parties are completely different. This diagram describes the supply of capital for Hard Money Loans vs. the demand for capital. Economics dictate that as the supply increases, demand decreases and conversely as supply decreases, demand increases.

A few years ago, I blogged about why HMLR’s were declining. This blog expands on the topic and discusses 10 of the many supply and demand related positive and negative influences on HMLR’s:

- Debt Capital Availability – Supply and Demand drives HMLR’s. The more capital pouring into financing private money loans forces lenders to lower their rates to acquire borrowers. Less capital chasing loans allow lenders to raise rates and their risk adjusted returns. HMLR’s will fluctuate depending on the Capital entering the hard money lending space from a wide range of sources including: Bank Lines of Credit, Individual investors leery of stock market volatility, Wall St. institutions, Hedge Funds, Fintech’s, Private Equity funds and REIT’s.

- Loan to Value (LTV) – Contrary to the Supply and Demand curve, LTV’s have a direct relationship to Hard Money Loan Rates. The lower the loan to value, the lower the Rate. As equity protection increases, the security of the loan increases and hence a lower rate will be acceptable to a Lender.

- Credit Score – Credit Scores do matter for Hard Money. While low scores are typically acceptable due to the underlying equity in the property, Credit Scores also indicate payment likelihood. Loan Rates differ for a person who has a low score due to a loss of a job or a medical issue vs. someone who can’t seem to manage their obligations. If you would like help improving your credit score, you might want to reach out to a credit repair company that can help increase your credit score. For more information, take a look at this recent overview of some of the most popular credit repair companies from Repair.Credit.

- Location – It is widely recognized that HMLR’s are lower in California than other States. The competitive lending market, a large population of borrowers seeking real estate (RE) fortune and the historical real estate appreciation bring more capital to the Golden State.

- Loan Term: The longer the loan term, the greater the risk of rate rising inflation. Shorter duration loans of 1-3 years carry less inflation risk and typically can be priced less expensively than >3-year loan terms.

- Ability to Pay – Typically, Business Purpose loans do not require the stringent Ability to Repay (ATR) rules of conventional consumer loans. However, Lenders do want to see where the income for the mortgage payments will come from. Positive cash flow income properties or other steady income streams will garner better HMLR’s.

- Product type – Liquidity matters. The more liquid the property type, the lower the Rate. SFR’s are the most liquid while Raw Land is typically the most illiquid.

- Benchmarks – The conventional lending world relies on LIBOR, the 10 Year Treasury, Fed Funds Rate and other benchmarks. HMLR’s don’t directly correlate to benchmarks, but capital flows follow yield.

- Current Real Estate Market Environment – Rising RE prices make profit seeking borrowers jump into purchasing or rehabbing. More borrowers during good times drive rates up and fewer borrowers drive rates down.

- Property Condition and Exit Strategy – Newer and already rehabbed properties have less construction risk and hence greater liquidity. Liquidity means a faster sale which reduces risk and lowers the HMLR. Other viable exit strategies including a clear path to a conventional refinance will also lower HMLR’s.

Mortgage Vintage keeps HMLR’s lower through origination excellence, sound underwriting and efficiencies gained through the CrowdTrustDeed marketplace. If you have a loan requirement, please contact us at 949-632-6145 or visit our website at https://mortgagevintage.com/ or www.crowdtrustdeed.com today.