Can we do a loan in 48 hours? Yes!

I received a call at Noon on a Wednesday from Paul. Paul, a Fix and Flipper and Home Builder, had borrowed successfully from Mortgage Vintage before and was now building infill homes. Paul had purchased some land in Orange County and was in the middle of construction on five new homes and had paid for everything in cash so far. The borrower had pre-sold one of the under construction houses and was expecting a payment, however that payment was delayed and the delay placed the borrower/home builder into a “cash crunch” situation. The borrower needed money desperately to make his construction crew payroll on Friday.

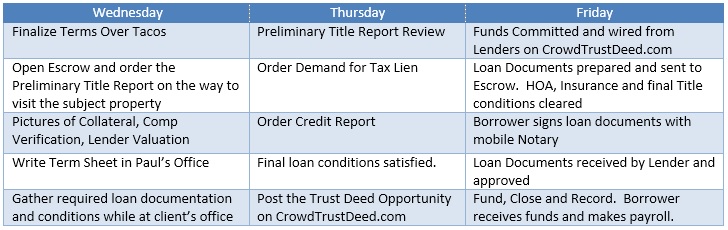

Paul called on a Wednesday and asked if he could get a loan by Friday of the same week. The borrower could not quickly get a conventional loan or acquire a loan against the under construction houses as contractor lien releases would be required. While discussing the loan scenario over lunch, Paul mentioned that he owned a free and clear office condominium nearby. The borrower now had provided the required collateral for a hard money loan. We agreed to the loan terms over Tacos and cleared the decks for a loan to make Paul’s payroll commitment. Here is the timeline for a 48 hour loan:

Not all loans happen this quickly, but whether you are a borrower, broker or lender here are 5 Key items to recognize and resolve if you are looking for a 48 Hour loan vs. a 48 day loan process:

- Understand Preliminary Title Report Priority Liens, Tax Liens, Judgements and Title Issues

- Borrower response time for requested items

- Order Payoff Demands immediately

- If dealing with a Commercial property, have Phase I/Phase II Environmental No Further Action documentation

- Quickly order or have Appraisals, Valuations or Broker Price Opinions ready