What does it mean to trust but verify during the underwriting process?

I enjoy meeting people and I prefer to go through life trusting people when we first shake hands. I always like to assume that people I meet are generally good people. However, these days our motto is and has to be “Trust But Verify”. As part of Due Diligence it is incumbent on a private money lender to validate and verify and cross check important due diligence items. Why? Below is a recent example of how active and thoughtful due diligence spoiled a borrowers attempt to “Dupe the Lender”.

I drove by a single Family Residence last week and we were considering a borrowers request for a cash-out loan on the investment property. I approached the property and noticed a concerned looking man on the front lawn. When I approached the house after parking the car, the man asked, “What are you doing?” I mentioned that I was a hard money lender and that I was looking at the house and comps to establish value for a potential loan. The man asked me who I was making a loan to and I mentioned the owner/borrower’s name. The man surprisingly told me I was wasting my time, that he was the attorney for the real owner and that our alleged borrower was a scam artist who had committed fraud, falsified county records and had attempted to put multiple loans on the subject property without being the real owner.

The man produced the “real” Trustees Deed and described the alleged Scam and how the top Title Insurer in the country could produce an inaccurate Preliminary Title Report and ownership records. I said Thank you and drove home thinking how fortunate I was to have uncovered the Fraud Plot. I notified the Title Company and the authorities are working on apprehending the culprit.

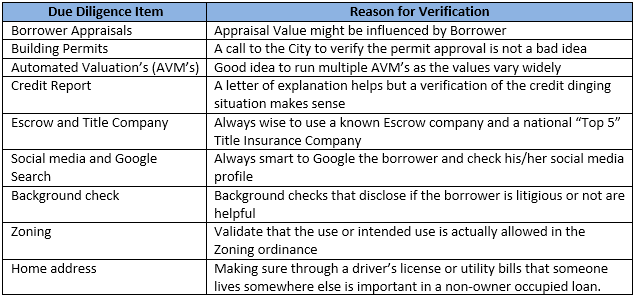

This harrowing experience reinforces our policy of “Trust But Verify”. Here are a few due diligence items that are many times taken at face value but should be verified: